REVENUE ACT OF 1861

(1st Federal Income Tax)

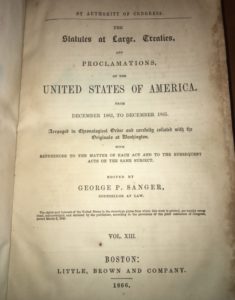

12 Stat. 292, Chap. XLV

Faced with the urgent need to fund the Civil War, Congress adopted the first income tax by imposing a flat tax of 3% on all income above $800. The Act also imposed the first national real estate tax, which was repealed the following year.

Section 49 of the Act is pictured. It was replaced by a progressive income tax in 1862.

The Revenue Act of 1862 imposed a 3% rate on income above $600 and a 5% rate on incomes above $10,000. The 1862 Act also created the Internal Revenue Bureau. To further support the Civil War additional taxes were imposed on luxury goods, spirits, tobacco, iron, steel, coal, paper, leather, silk, cotton and other commodities. Gross receipt taxes were also imposed on railroads, steamers, and express companies.

Still inadequate to cover Civil War expenditures, the Internal Revenue Act of 1864 established a progressive tax system of: 5% on income staring at $600; 7.5% on income at $5,000; and 10% on income over $10,000.

Click here for the full text of the Act:

Addition reading:

http://www.loc.gov/rr/business/hottopic/irs_history.html